Published on: October 25, 2025

Why I Prefer the Gemini Credit Card Over Traditional “Points” Cards

If you’ve ever chased airline redemptions or hoarded a mountain of “points,” you know the uneasy feeling: the rules can change right when you’re finally ready to book.

That’s the core problem with traditional points ecosystems—they’re closed currencies with terms set by someone else. The Gemini Credit Card takes the opposite approach: it turns your everyday spending into an investment-like asset you control—crypto—rather than a liability-prone points balance.

Below I break down how points quietly lose value, how Gemini’s rewards work (including current categories and fees), the regulatory hurdles Gemini has navigated, and why I think the card creates a path to appreciable rewards instead of vanishing value.

The problem with points: shadow currencies that devalue

Points aren’t dollars. They’re a private currency whose issuer can rewrite the exchange rate. Over the last few years, airlines (and many travel programs) have steadily raised award prices, moved to dynamic pricing, and reduced saver availability. The net effect is a slow drip of devaluation: you need more points for the same seat, or you settle for off-peak, less convenient routes.

Independent analyses keep documenting this trend. A 2024 deep dive called airline points “convoluted shadow currencies,” describing how award costs keep creeping up, even as programs get more complex. Bloomberg In 2025, multiple outlets reported fresh devaluations and higher award costs across programs—another reminder that hoarding points is risky because the goalposts move. View from the Wing+3Simple Flying+3The Guardian+3

A simple example. Say you’ve been eyeing a first-class ticket that today costs 1,000,000 points. You keep saving until you hit 2,000,000—then the program updates its chart and that same seat jumps to 1,500,000. Overnight, your careful savings effectively lose purchasing power. Your “balance” went up, but your buying power went down.

Gemini flips the script: rewards that can appreciate

The Gemini Credit Card pays crypto on purchases, not points. That’s the philosophical difference: instead of building a pile of miles with uncertain value, you’re collecting an asset class with market-based upside (and, to be fair, downside). Rewards post quickly (often immediately), there’s no annual fee, and you can choose among supported cryptocurrencies for your rewards. CreditCards.com+1

Current earning structure (as of today):

Up to 4% back on Gas/EV/Transit (on the first $300 in those categories each calendar month, then 1% after)

3% back on Dining

2% back on Groceries

1% back on everything else

No annual fee, no fee to receive crypto rewards, and no foreign transaction fees are promoted benefits. Gemini+1

Gemini has been expanding the ways you can take rewards, recently highlighting Solana and XRP “editions” of the card—essentially themed options that align with a specific asset while keeping the same earning structure. Gemini+2CardRates.com+2

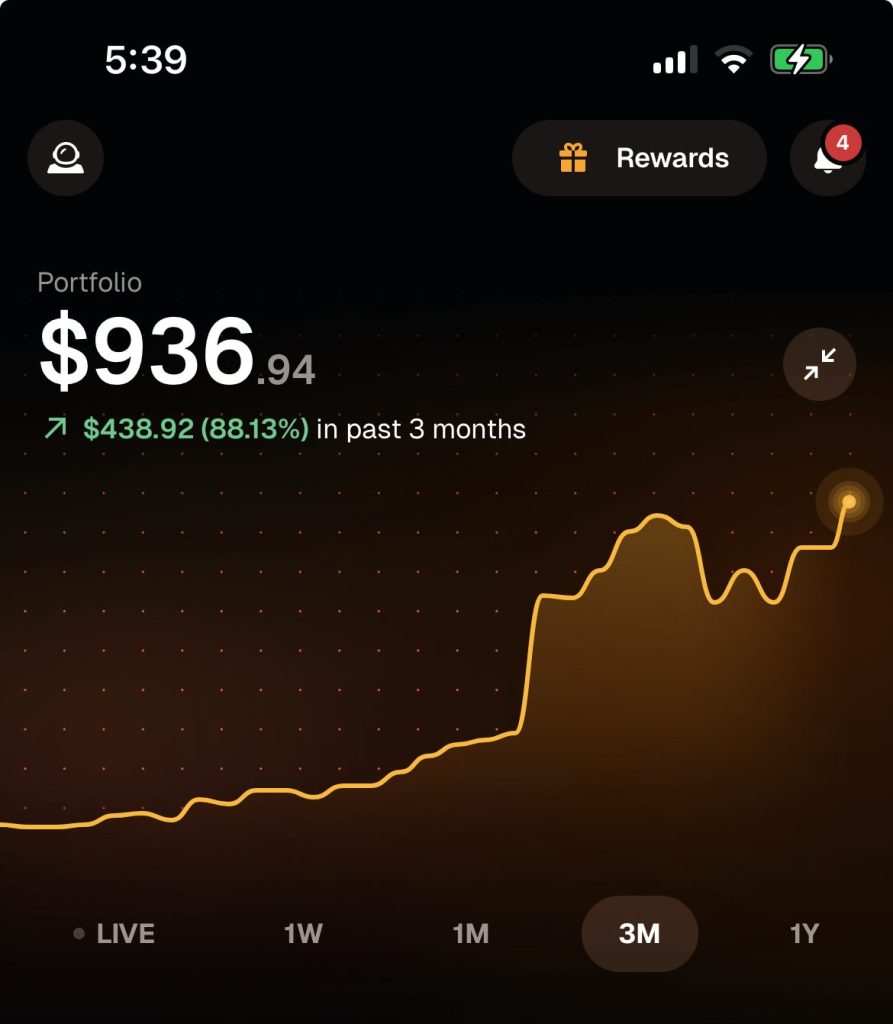

Personal note: I signed up in August and received about $400 worth of crypto in the first few months. Within ~90 days, the market value ballooned to over $900. That kind of move is exactly what points can’t do: they don’t “run” when markets run; they only shrink when programs tighten terms.

The wealth effect: compounding vs. devaluing

Think of points as a savings account with a floating withdrawal penalty—the issuer can change how far your points go. By contrast, think of crypto rewards as equity-like: volatile, but with upside and the potential to compound if the asset appreciates.

You decide the asset. Prefer a large-cap network? Select Bitcoin. Want smart-contract exposure? Choose something like Solana. You can change your selection over time as your thesis evolves (Gemini says cardholders can alternate among crypto rewards). Gemini

You own the underlying, not an IOU. Points live inside a walled garden. Crypto rewards are crypto—transferable, tradable, and (if you choose) holdable long-term.

Market-linked upside. Gemini has even published analyses spotlighting periods when holding a given asset (e.g., an XRP “edition”) would have dramatically outperformed the face value of rewards. While past performance isn’t a guarantee, it illustrates the core idea: value can grow. Gemini

Of course, markets can move both ways. The responsible approach is to treat crypto rewards like any volatile investment: pick an allocation that matches your risk tolerance and time horizon, and consider periodic rebalancing.

What about trust? Gemini’s regulatory journey

In early 2023, Gemini and a lending partner (Genesis) were sued by the SEC over the Gemini Earn program, which allowed customers to lend crypto in exchange for yield. In March 2024, Genesis agreed to a $21 million SEC settlement over those charges, and in September 2025, Gemini and the SEC informed a federal court of a settlement-in-principle expected to fully resolve the SEC’s lawsuit (pending final approvals and filings). SEC+2Wall Street Journal+2

While the Earn case wasn’t about the credit card, it understandably raised questions for anyone evaluating Gemini as a platform. The important takeaway is that the matter has moved through settlements and toward resolution in court filings—an indicator of regulatory progress.

A fair comparison: points vs. crypto rewards

1) Transparency of value

Points: Value per point is opaque and variable; issuers can devalue or restrict availability. Multiple analyses and news reports in 2024–2025 show a broad trend toward higher award prices. View from the Wing+4Bloomberg+4Simple Flying+4

Crypto: Value is transparent and market-quoted 24/7, though volatile.

2) Ownership & portability

Points: Locked to a program; transfers and partners are at the issuer’s discretion.

Crypto: Real, transferable assets; you can hold, sell, swap, or move to self-custody (subject to platform features and network fees).

3) Earning structure

Points: Often strong category bonuses but redemption complexity.

Gemini: Up to 4% on transit/gas (with monthly cap), 3% dining, 2% groceries, 1% on everything else; no annual fee; fast reward posting. Gemini+1

4) Long-term wealth potential

5) Flexibility of reward choice

Points: “One currency” with occasional transfer partners; redemption rules can change.

Gemini: Choose your reward asset; recent emphasis on specific asset editions (e.g., Solana, XRP). Gemini+1

Who should consider the Gemini Credit Card?

Investors at heart. If you view rewards as a piece of your portfolio, crypto pays you in an asset class with real upside.

Travelers tired of the game. If you’ve been burned by blackout dates, dynamic award charts, and “moving goalposts,” crypto rewards cut out the middleman.

Fees-averse cardholders. No annual fee, no fee to receive crypto rewards, and no foreign transaction fees are compelling if you dislike paying for the privilege of earning. Gemini

Smart ways to use the card

Pick a primary asset thesis. Start with one crypto (e.g., BTC for long-term store-of-value exposure) and reassess quarterly.

Automate discipline. Treat rewards like dollar-cost averaging—steady inflows regardless of price.

Rebalance when life changes. Need liquidity? Convert a portion. Feeling overexposed? Rotate to a stablecoin or diversify among assets (subject to what Gemini supports for rewards at the time).

Gemini Support

Mind the cap. Remember the 4% transit/gas bonus applies to the first $300 monthly before dropping to 1%. Plan big fuel or rideshare months accordingly.

Gemini

Bottom line

Traditional points are promises; crypto is property. If you want rewards that can grow instead of balances that quietly buy less each year, the Gemini Credit Card offers a clean, transparent alternative: earn in the assets you believe in, with straightforward category bonuses, fast posting, and no annual fee. For me, that’s the difference between chasing a moving target and building something that might compound.

Sources

Disclaimer: Crypto involves risk, including loss of principal. Rewards programs and supported assets can change—always check current terms before applying or planning redemptions.